Hounded by President Recep Tayyip Erdogan last summer, its credibility was in tatters for waiting to aggressively raise interest rates to halt a run on the lira.

But the rehabilitation is now in full swing after the Monetary Policy Committee barely tinkered with its projections for inflation and signaled it remains reluctant to cut borrowing costs. Investors cheered the thinking, sending the lira to the best performance in emerging markets on Wednesday.

Despite a faster slowdown in price growth than the central bank was anticipating, Governor Murat Cetinkaya said he still needs to see a “convincing” deceleration before taking action. The view is almost universal among economists that any monetary easing now would be premature.

“The central bank deserves credit for publishing an inflation report which is market-friendly,” said Rabobank strategist Piotr Matys. “The latest inflation report and remarks from Governor Cetinkaya imply that the central bank has a very good understanding of what the market expects in terms of monetary policy.”

| SURVEY OF EXPECTATIONS | CENTRAL BANK PROJECTION | OFFICIAL TARGET | |

|---|---|---|---|

| Year-end 2019 | 16.5% | 14.6% | 5% |

| Year-end 2020 | 12.4% | 8.2% | 5% |

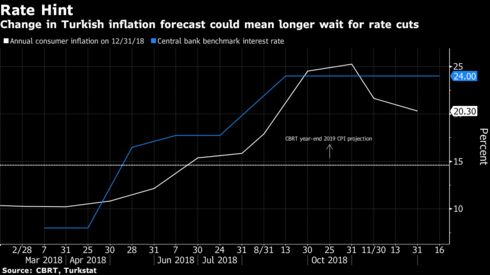

Under the central bank’s base-case scenario released on Wednesday, inflation will end this year at 14.6 percent, compared with its previous call of 15.2 percent. The governor pointed to lower oil prices, currency appreciation and weaker domestic demand as reasons for the slowdown. For now, the MPC still has “to continue with a high level of caution against potential upside risks” to inflation, according to Cetinkaya.

“We will continue to maintain the level of tightness necessary to achieve single-digit inflation in the shortest period of time possible,” he said in Ankara.

Read more: Turkey Looks Set for ‘Soft Landing’ to Albayrak After Lira Crash

The outlook for inflation has turned more favorable as the lira stabilized following its crash last summer. But the MPC is treading carefully and hasn’t toned down its hawkish rhetoric even as price growth declined from a 15-year high to just over 20 percent. It’s next scheduled to set borrowing costs in just over a month. The benchmark was kept at 24 percent at the past three meetings.

The central bank’s “strong wording” and a commitment to stick with policy that brings inflation below 10 percent has resulted in “positive sentiment in the currency market,” according to Muhammet Mercan, chief economist at ING Bank AS.

“This stance shows that despite the recent favorable developments on the inflation front, the bank will focus on credibility-building and remain on hold until annual inflation’s expected downtrend from June onward,” Mercan said.

Easing won’t resume until the second quarter, with the key rate ending this year at 20 percent, according to the median forecasts of economists polled by Bloomberg.

The MPC doesn’t expect to approach its inflation target for three more years, with projections showing price growth at 5.4 percent in 2021. Turkey’s central bank last met its goal in 2010, when it was at 6.5 percent. It’s since been lowered to 5 percent.

| What Our Economists Say… |

| “The next CBRT meeting, scheduled for March 6, is probably too soon to start the easing cycle. The central bank is likely to take a cautious approach to avoid potential surprises for investors and risking a run on the lira ahead of local elections on March 31.”–Ziad Daoud, Bloomberg Economic |

The Turkish currency was trading 0.6 percent stronger against the dollar as of 4:45 p.m. in Istanbul, on track for the biggest jump in a week. The yield on the government’s 10-year bond fell 28 basis points to below 15 percent.

“Markets are appreciating the Turkish central bank’s return to orthodoxy,” said Timothy Ash, a strategist at BlueBay Asset Management in London.

— With assistance by Kyungjin Yoo, Firat Kozok, and Constantine Courcoulas