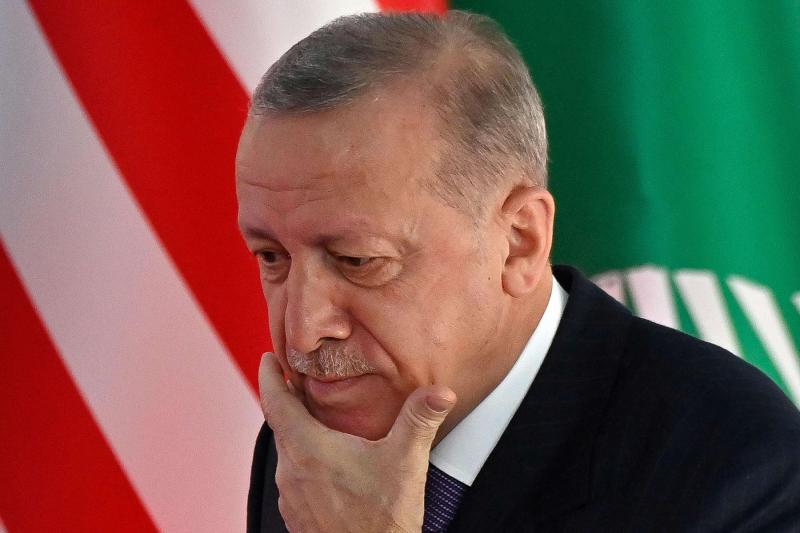

Turkey’s economy is expected to record double-digit growth in 2021, President Tayyip Erdoğan said on Thursday, higher than a previous government forecast of 9 percent, Reuters reported.

“Even though international institutions say 9 percent, we think that we will reach double-digit growth numbers at the end of the year,” Erdoğan said in a pre-recorded message.

Turkey’s economy grew 21.7 percent year-on-year in the second quarter.

In the meantime, the European Bank for Reconstruction and Development (EBRD) said Turkey’s economy will grow by 9 percent this year, contrary to Erdoğan’s double-digit growth expectation, buoyed by a revival in exports and tourism, but the central bank’s “confusing” policy approach and high inflation could yet harm the recovery.

The EBRD also said in a report published on Thursday that it expects Turkey’s economy to settle near potential growth of 3.5 percent next year, driven by exports, though it added rising energy prices and premature rate cuts pose risks.

The EBRD, which updated its global economic outlook, had forecast in June that Turkey’s economy would grow by 5.5 percent in 2021 but raised its estimate amid strong domestic demand and exports and the reopening of the crucial tourist sector as the pandemic eases.

The central bank has slashed its key interest rate by 300 basis points since September despite high inflation, unnerving investors and sending the lira currency to record lows.

Annual inflation rose to 19.9 percent in October, leaving real rates deeply negative. Any further sharp lira depreciation could harm Turkey’s ability to meet external debt payments, the EBRD said.

The central bank says inflation is temporary and has signaled more, albeit less aggressive, easing before the end of the year. Last week it said achieving a current account surplus would ease lira pressure.

Roger Kelly, lead regional economist at the EBRD in İstanbul, said the central bank’s new focus on the current account sent a “confusing message” that suggested policy would be “relatively loose going forward.

“So there is a chance that we see further rate cuts this year and a weaker lira, (and) clearly there are risks to that,” he said.

Negative real rates of nearly four percentage points are not sustainable given Turkey’s reliance on foreign capital, Kelly told reporters in a briefing.

“If you are an economy that is heavily dependent on foreign capital and known to have a fairly unpredictable policy environment, then clearly people are going to pull their capital at the first opportunity if they see things deteriorating,” he said.

The lira has shed more than 20 percent against the dollar this year, with more than half of the losses since September.

Analysts say President Erdoğan’s public push for monetary stimulus has influenced policy decisions and hurt central bank credibility.

***Show us some LOVE by sharing it!***