Still reeling from the aftermath of the currency crisis in summer 2018, Turkish corporations are poorly positioned to weather a fresh storm caused by the coronavirus pandemic, according to market participants polled by Debtwire.

“The next wave of restructuring was expected to hit at the end of 2020 or beginning of 2021, but it will be earlier now,” an Istanbul-based financial advisor said.

But a surge in lending – particularly from state-owned banks – and government decreed reductions in local interest rates mean that many companies will be able to refinance their debts.

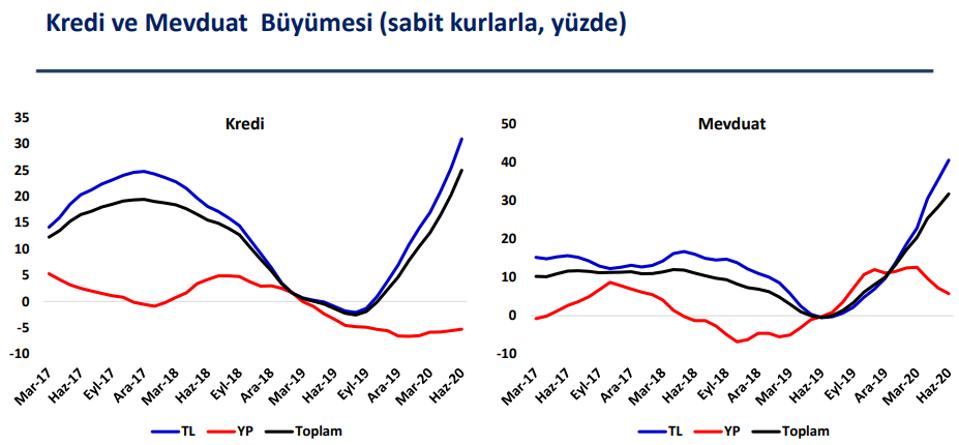

According to statistics from the Central Bank of Turkey, loan growth in the banking sector amounted to 30.35% year-on-year.

“There is a state of relief right now with the provision of additional liquidity and legal protections for three-to-six months because of COVID-19,” the financial advisor continued.Recommended For You

While Turkey’s main state-owned lenders – Halkbank, Ziraat Bankasi and Vakifbank– may not have lead some recent transactions, they have provided more than 70% of domestic commercial loans since the beginning of the year, said a lawyer.

Of some 72.4 billion Turkish lira-worth of new local currency credit provided between March 6 and April 10, 52.6 billion came from state-owned banks, according to a Sozcu report.

“All banks – but especially state-owned banks – are providing big loan volumes with really low interest rates,” said a second Istanbul-based financial advisor, adding that in the current environment, lenders are very flexible in terms of extending debt maturities.

The weighted average interest rate of Turkish lira-denominated commercial loans (excluding corporate overdraft account and corporate credit cards) has fallen to 9.61% today, compared to 23.81% in July 2019, according to Turkish Central Bank data.

Meanwhile, for U.S. dollar commercial loans, the average rate has dropped to 3.49% from 7.42% over the same period.

Credit and deposit growth March 2017 to June 2020

TL= Turkish lira; YP= FX; Toplam= Total

Earlier this year, both Yildiz Holding and Dogus Holding, two Turkey-based conglomerates that concluded debt restructurings in 2018, separately announced that they were in talks with their creditors to lower the interest rates on their syndication deals.

With the heavy involvement of state-owned banks in the latest wave of financial distress, there remains little incentive to put in place an effective restructuring framework that allows haircuts, as opposed to amend-and-extend solutions, said the first financial advisor.

Watchlist sectors

Turkey’s crucial hospitality and tourism sectors have been particularly hard hit by the COVID-19 outbreak. Turkey’s tourism revenue in 2019 was as much as $34.5 billion, but the country will be lucky if it generates $10 billion this year, the first financial advisor said.

Many banks have postponed loan repayment dates for six to 12 months for companies working in the hospitality sector, he continued.

Wholesale retailers and aviation have been pummelled by COVID-19 lockdowns globally. The big airlines in Turkey, such as Turkish Airlines and Pegasus will survive, but will likely face serious capital erosion, according to the financial advisor. However, second-tier market players in the service sector, such as airport operators and caterers, will be very badly hit, he added.

Elsewhere, shopping malls are open in Turkey, but foot traffic is well below pre-coronavirus levels, raising significant concern throughout the wholesale retail sector, the first financial advisor continued.

Falling exports to the European Union are another cause for concern and although there has been a partial recovery, growth remains sluggish, he added. Turkey’s export volume to the EU declined by 9% in 1Q20, Ministry of Trade data show.

Lastly, the automotive sector is also on the watchlist of all financial restructuring advisors globally. For Turkey, first-tier automotive parts suppliers are on the radar, said the first financial advisor.

Total production in the automotive sector in the first half of 2020 declined by 28%, while automobile production fell by 26%, Sozcu reported.

Suppliers were still able to collect their money since the payments in this sector are usually done within 60 to 90 days after procurement. The true decrease in cash flows will be seen in July, August and September, the first financial advisor added.

Risky recovery

The lending-led recovery that Turkey’s Minister of Treasury and Finance Berat Albayrak has pushed since the 2018 currency crisis could prove dangerous in the current situation, noted an international investor, delaying – and potentially expanding – an eventual credit crunch.

So far, President Recep Tayyip Erdogan has steadfastly refused to countenance a deal with the IMF, which would, according to the investor, help Turkey deal with its fiscal response and corporate debt restructuring. Whether Erdogan will change direction in this regard “nobody knows,” the investor concluded.

By Asli Orbay-Graves

Asli Orbay-Graves is senior reporter at Debtwire CEEMEA, covering debt restructuring and litigation. She can be reached at [email protected].