Turkish President Recep Tayyip Erdoğan and Finance Minister Mehmet Şimşek offered a confident response to the latest wave of U.S. tariffs, saying Turkey is well-positioned to withstand global trade tensions and may even emerge stronger than other emerging economies.

Speaking to lawmakers from the ruling Justice and Development Party (AKP) on Wednesday, Erdoğan said Turkey does not expect the new U.S. tariffs to negatively impact its trade, production, or exports. “There is serious uncertainty in the world,” he said, “but there is a strong economic program that illuminates Turkey’s path.”

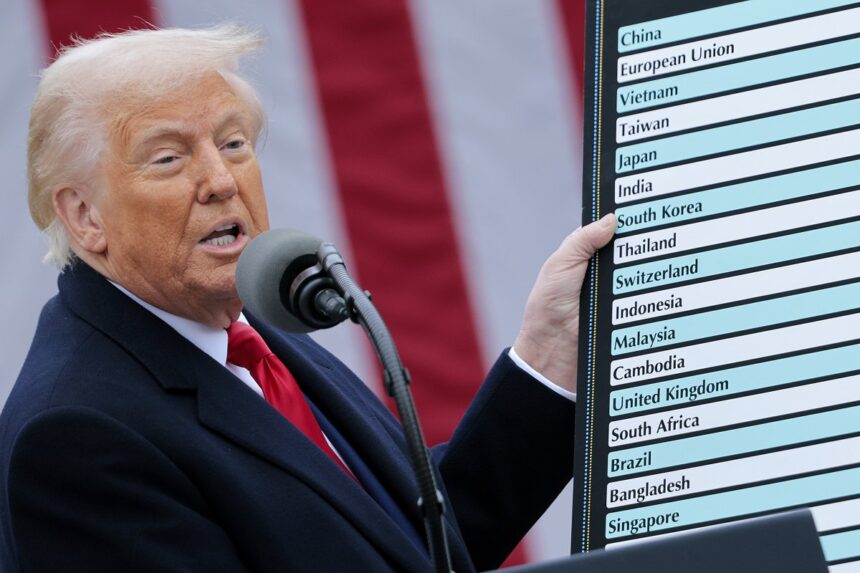

The new 10 percent tariff, imposed by U.S. President Donald Trump and effective as of today, applies to all goods imported into the U.S., including those from Turkey. Ankara was among a limited number of countries hit with a baseline reciprocal tariff, notably lower than the higher rates many other emerging markets face.

Finance Minister Şimşek echoed Erdoğan’s optimism in an interview with the Financial Times, emphasizing Turkey’s limited reliance on U.S. trade — just 5 percent of its total trade volume — and the benefits of declining oil prices. “When the dust settles, we hope and believe Turkey could positively decouple from other emerging economies,” Şimşek said.

Despite ongoing global uncertainty, Erdoğan reaffirmed that Turkey’s inflation-reduction strategy remains on track. He pledged to uphold fiscal discipline and continue the cost-cutting measures initiated last year.

According to the Turkish Statistical Institute (TurkStat), the U.S. ranked as Turkey’s ninth-largest export destination in 2024, with bilateral trade totaling over $32.5 billion. Key Turkish exports to the U.S. include automotive parts, white goods, steel products, textiles, and machinery.

Turkey’s broader economic reform program, launched 18 months ago, has shown early signs of success. International reserves have been rebuilt, and inflation has dropped to 38.1 percent in March from a peak of 75 percent in May last year. Interest rates currently sit at 42.5 percent.

However, recent political unrest — particularly the arrest of Istanbul Mayor Ekrem İmamoğlu — has rattled investor confidence and triggered the largest street protests in a decade. The central bank responded by raising interest rates and spending billions to stabilize the lira, which has since regained footing.

Şimşek acknowledged that the economic slowdown could lead to a wider-than-expected budget deficit but stressed that controlling inflation remains the top priority. “We will maintain spending discipline regardless,” he said.