The Turkish Treasury has sold $1bn worth of USD-denominated eurobonds due April 2029 at a coupon rate of 7.625% and a yield to the investor of 7.15%, the Ministry of Treasury and Finance announced on March 20.

Initial price guidance on the 10-year paper was set at 7.25%, unnamed bankers told Reuters on March 19.

The offering attracted an orderbook approximately three times the issue size, according to the Treasury.

At the previous auction held in January for identical paper, the Treasury raised $2bn at a yield to the investor of 7.68% and a coupon rate of 7.625% while the spread over US Treasury paper hit 497bp.

At the latest auction, the spread over US Treasury yields declined to 454bp.

The total amount of the USD bond issuance was converted into an equivalent EUR liability. As a result of this swap transaction, the EUR-denominated coupon rate was realised as 4.859%, lower than the 4.965% recorded at the previous auction held in January. The EUR-equivalent yield to the investor was realised as 4.381%.

Recession-hit Turkey has raised $5.4bn on the international capital markets in 2019 to date at three auctions (See table below). Turkish private corps have also been in a rush to hit screens with eurobond sales since the beginning of the year.

External vulnerability risk moved to High+

Moody’s Investors Service upgraded Turkey’s external vulnerability risk to High+ from High due to its high external financing requirements, the rating agency said on March 19 in a non-rating credit opinion report.

The rating agency said it expected Turkey’s current account deficit to contract because of declining consumption and investments, but that the external financing requirement would remain high due to external debt stock. It was also concerned by the country’s relatively low FX reserves.

Moody’s also warned that tensions with the US over Ankara’s planned S-400 missile defence system purchase from Russia and Germany’s latest warning to its citizens visiting Turkey—issued because of the deteriorated human rights picture in the country—carried risks that could hit the Turkish lira (TRY). Sanctions could feasibly follow if Nato member Turkey makes an S-400 deployment.

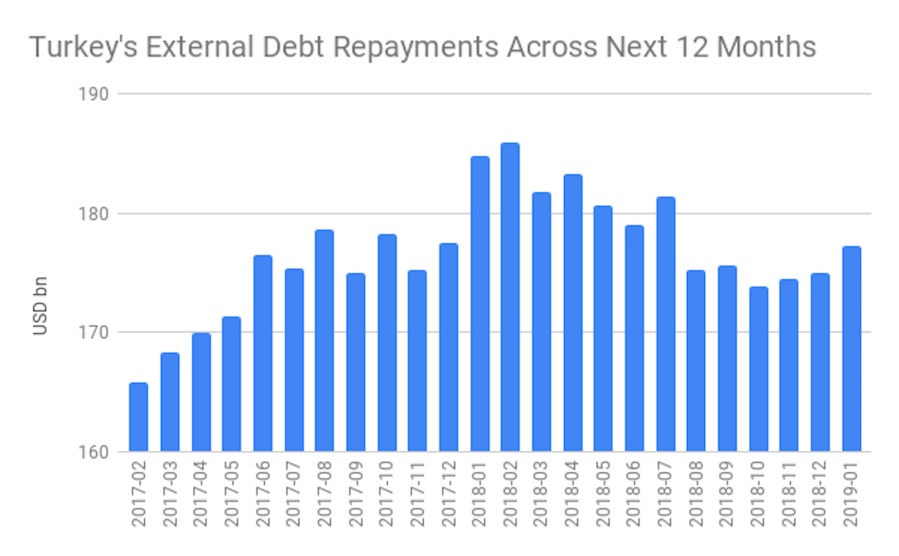

Turkey’s external debt repayment obligations within one year reached $177.3bn as of end-January, the highest level seen since July, the central bank said on March 15.

The one-year external debt repayment obligations saw a record high of $185.9bn as of end-February 2018 and stood at $181.3bn as of end-July, prior to the currency crash in August.

Fitch Ratings rates Turkey at BB/Negative, two notches below investment grade, together with Guatemala and Vietnam. Moody’s Rating Services rates Turkey at Ba3/Negative, three notches below investment grade, together with Bangladesh, Bolivia and Vietnam, while Standard & Poor’s rates Turkey at B+/Stable, four notches below investment grade, together with Kenya and Greece.

Source: bne intellinews