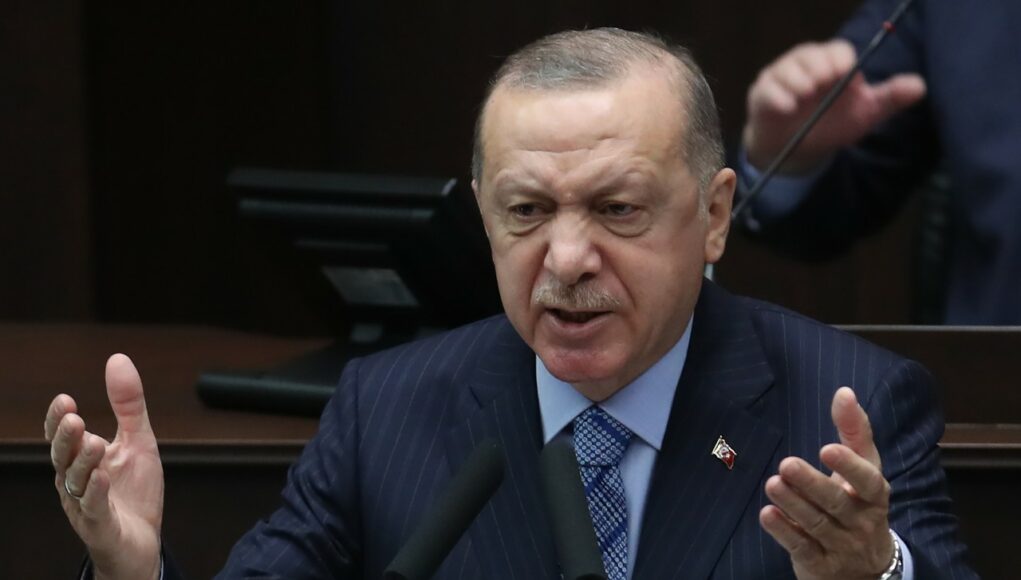

Turkish President Recep Tayyip Erdoğan on Wednesday argued that some $128 billion, which is claimed by the opposition to have been sold from the Turkish Central Bank (TCMB)’s reserves in 2019-2020, was still “in the people’s Treasury and the central bank,” according to local media reports.

Although Erdoğan and his monetary policymakers are trying to downplay the issue, the public, experts and the opposition have been demanding to know where the $128 billion has gone.

The president claimed in a statement two weeks ago that a significant part of the forex reserves, which dropped sharply under the watch of his son-in-law and then-finance minister Berat Albayrak, were used to stabilize the lira to enable the country to overcome the pandemic with minimal damage.

Albayrak oversaw a policy in which state banks sold some 128 billion in dollars in 2019-2020 to stabilize the Turkish lira. The TCMB backed the interventions with swaps, and the bank’s net forex reserves subsequently tumbled by about three-quarters last year alone.

Erdoğan once again defended his son-in-law’s policies on Wednesday while he addressed lawmakers from his Justice and Development Party (AKP) in parliament.

“They’re hung up on where the money is. The money is in the people’s Treasury and the central bank. Nothing is lost,” he said, in reference to the opposition politicians.

However, Erdoğan’s remarks didn’t reflect the truth, local media reports said, since the TCMB’s net forex reserves rose to $13.93 billion as of Feb. 26, according to bank data, and its outstanding swaps were $40.67 billion as of March 9, which means the reserves are in deeply negative territory once the swaps are deducted.

After the main opposition Republican People’s Party (CHP) blamed Albayrak for Turkey’s economic woes and depleted forex buffer, Erdoğan began late last month to defend policies of the former minister, who abruptly resigned from his position in November and has not been seen in public since.

The lira, which began to gain value against the US dollar following Albayrak’s resignation, has declined in recent weeks in part because Albayrak’s legacy has resurfaced, raising the possibility of his return to government, analysts say.

Source: Turkish Minute