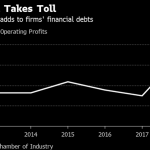

Financing costs climbed to 89 percent of operating profits – up from about 50 percent in 2017, reported the Istanbul Chamber of Industry [Murad Sezer/Reuters]

Ankara, Turkey – The steep fall in the Turkish lira since last summer has left the top industrial firms in Turkey struggling to cover financing costs, a leading Turkish business group said Tuesday.

The 2018 survey of the country’s top 500 industrial firms by the Istanbul Chamber of Industry (ISO) showed that financing costs are a growing burden for Turkey’s industrial giants.

Turkey depends heavily on external financing. As the lira has plunged in value, the cost of financing loans denominated in foreign currencies has gone up for Turkish borrowers. The steep rise in foreign-borrowing costs is eating into corporate profits, according to the report, which was released on Tuesday.

Shrinking profits

Oil refiner Tupras, which topped the ISO table, showed a fall in operating profits from 4.178 billion lira ($690m) in 2017 to 3.911 billion lira ($650m) last year.

The lira lost around a third of its value against the dollar in 2018 and has dropped around 14 percent so far this year. The plunge has left thousands of companies struggling to make repayments on dollar and euro loans. Some have sought bankruptcy protection.

“Some companies will have dropped out of the top 500 this year due to bankruptcy problems,” Can Selcuki, general manager of Istanbul Economics Research, told Al Jazeera. “Those companies that have foreign revenues and are big exporters are better protected.”

For years, Turkey’s economy showed double-digit growth, largely supported by cheap credit, particularly in the construction sector. However, towards the end of last year, the country slid into recession.

In a bid to shore up the faltering lira last fall, Turkey’s central bank hiked interest rates to 24 percent and has held them steady. But many lira-earning firms have found it increasingly difficult to service their foreign currency debts.

“The loss of profitability is heavily connected to foreign debt as well as high interest rates,” said Taylan Buyuksahin, economics editor at opposition newspaper Sozcu.

“Last year, these industrial firms were going in the right direction but the currency shock waves in 2018 reversed this. We have also seen a drop in confidence in the Turkish market and there is a lack of trust and confidence that is putting off foreign investment.”

In its report, the ISO said just 381 of the top 500 firms showed a profit in 2018, down from 422 firms the previous year, while financing costs climbed to 89 percent of operating profits – up from about 50 percent in 2017. This metric is important because it shows how the debt-service burden is eating away at profits.

Speaking at the release of the report, ISO chairman Erdal Bahcivan told reporters, “negative development in financial stability, extreme turbulence or volatility unfortunately damages our companies even if they protect themselves.”

Weakening business confidence

The survey came on the same day that Turkey’s Central Bank reported an 8.5 percent drop in the economic confidence index.

Contributing to growing concern among investors are factors that include the rerun of the mayoral election in Istanbul – which was voided in March and is rescheduled for June 23 – and the prospect of US sanctions over Ankara’s planned acquisition of Russian missiles.

Uncertainty around the second Istanbul vote – called after the ruling Justice and Development Party’s candidate lost to the opposition amid claims of ballot irregularities – could set back hopes for an improvement in business conditions, Bahcivan said.

Calling on companies to change their financing models, he added: “We need to use capital markets, company mergers and partnerships.”

SOURCE: AL JAZEERA NEWS