So, here we are again—past seven. It’s taken 21 months but the Turkish lira has again weakened through the psychologically important 7.00-to-the-dollar level not seen since Turkey’s August 2018 currency crisis, which brought an all-time nadir of 7.23.

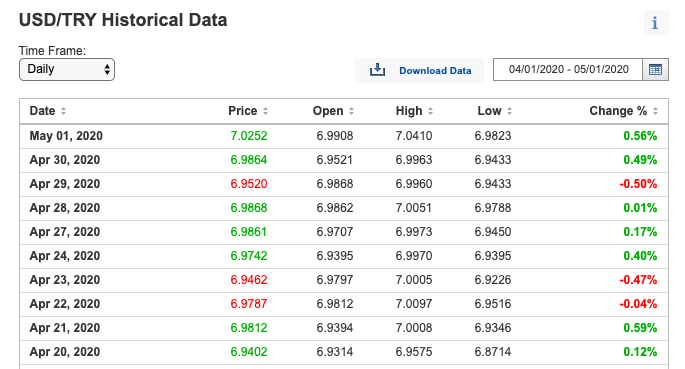

Quite why 7.00 is so psychologically gripping is a mystery (there were plenty of rational jitters and hands thrown skywards at 6.50, 6.75 or 6.99, why wait till 7.00 before making your mind up?). What’s more, since April 21, the USD/TRY rate has tested 7.00 a few times, it’s just that on each occasion it was for only a few seconds, and it didn’t, as it did on May 1, tangle with 7.01. However, this time around the TRY took a tumble to 7.04 and the market threw a wobbly. The lira was trading at 7.0077 as of 01:00 Istanbul time on May 2.

After the breach, that came during public holiday trading, Reuters reported Turkey’s dollar-denominated bonds falling across the board, with the 2041-maturing bond down just over 0.9 cents and other shorter-dated bonds lower by 0.1 and 0.8 cents.

It was bad news for Turkish eurobonds, which had been recovering lately thanks to domestic buys following the hit dealt by the coronavirus (COVID-19).

Boxes ticked

Meanwhile, all boxes are locally and globally ticked for a second market dip on the Borsa Istanbul, which has recently been meaninglessly imitating the meaningless recovery on global equity markets.

“Markets today: You’ve the FED if you price, corona medicine [remdesivir] if you buy, now don’t bother yourself with the bad [Q1] financials,” Gokhan Uskuay of Tacirler Invest wrote in a wry April 30 tweet on the difficulties of selling rotten fruit.

“The Ship of Fools lurches violently from port to starboard as all passengers on deck run to one side screaming ‘SELL!’ and then just as it seems the vessel must capsize, they all run back to the other shouting ‘BUY’,” Julian Rimmer of Investec wrote on April 29 in a note to investors.

On April 24, Bloomberg reported that gold bars were being flown 11,000 miles from Australia to New York to ease a supply squeeze. Following the first wave of corona, the idea of buying something tangible, something you can touch, may come back into fashion should enough quizzical passengers aboard the heaving galleon grow distrustful of the digital numbers placed in their accounts.

Corona has done a fine job of making everyone forget the trade war, the oil war and so on and so forth, but it is also good to remember that only the first four months of ill-starred and downright spooky 2020 are over.

The future is just too unpredictable for the S&P 500 to be trading at 17 x 2021 earnings estimates, billionaire investor Carl Icahn—who is hoarding cash, shorting commercial real estate and preparing for the coronavirus to wreak more havoc—told Bloomberg on April 25.

No surprises here

Despite the temporary relief on the global front, market traders were on April 30 rather grouchy in complaining that the Turkish central bank had for more than a week been burning up depleted foreign currency reserves in the fierce battle to keep the lira stronger than seven per dollar. And, they whined (why does anything about this Erdogan administration still surprise them?), the national lender was going about shedding its already thin FX holdings despite the huge added strain the pandemic had placed on Turkey’s already fragile economy and also the further interest rate cuts, along with quantitative easing (QE), it had brought in to try and steady the vessel.

The advent of “Turkish QE” was an understandable move given the need to provide a quick lifeline to people financially stranded by lockdowns, but populist regimes do tend to go on a binge given half a chance.

Turkey’s central bank has been accelerating its purchases of debt since last month with the cash-strapped government on the hunt for more money to counter the effects of the country’s severe COVID-19 outbreak (seventh worst by number of infections in the world by now, and perhaps even worse if—forgive the impudence—the official statistics are not all they’re cracked up to be), Bloomberg reported on April 28 in a story entitled “Copying Rich World’s Virus Plan Is Big Risk for Emerging Markets”.

Dear Leader President Recep Tayyip Erdogan is, as always, one step ahead of his pals as he goes about simultaneously printing money and selling central bank reserves to slow the lira depreciation.

“Two fingers to logic”

“It’s actually quite interesting seeing someone trying to give two fingers to economic or financial logic,” one foreign fund manager, who asked not to be named, told the Financial Times, adding: “They’re really digging themselves quite a decent hole.”

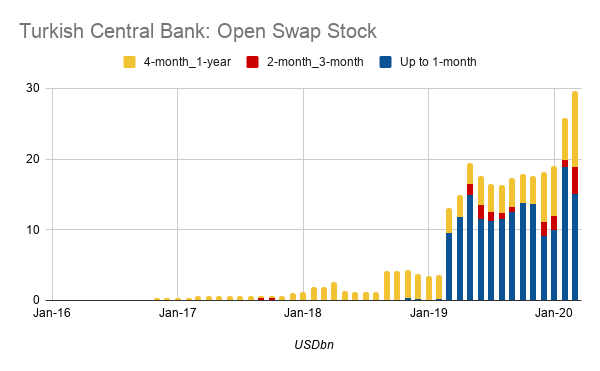

“They”, namely Erdogan, the genius that is his son-in-law finance minister Berat Albayrak and their clan of advisers, have been digging that “hole” since November 2018. Lowering the tape measure into the depths, you find that the central bank’s gross FX reserves had fallen by almost $25bn to $52.7bn as of April 24 from $77bn at end-February (based on lagged official data from the regulator’s weekly bulletin released on April 30).

The IMF-defined FX reserves, which exclude gold and short-term swaps, fell below zero at end-February while the figure without the exclusion of gold dropped into negative territory as of mid-April.

Haluk Burumcekci of Burumcekci Consulting regularly calculates the amount of dollars sold by state lenders in terms of the difference between disclosed net reserves and how much they should actually amount to.

Accordingly, Erdogan (for make no mistake, it is he who calls the shots at the central bank, as elsewhere) sold $66bn from January 2019 to March 2020, including $32bn in Q1 2020.

Since there is no official data, calculations in circulation may slightly differ. Unnamed bankers cited by Reuters concluded that Erdogan sold $32bn last year and another $32bn or more in Q1 this year.

The quoted figures do not include sales in April nor the dollars thrown into the mix on the first day of May since the official data on swaps comes in trailing one month behind.

But it is not just Turkey’s leader who is raising eyebrows on the currency markets. His arch-enemy, Egyptian coup leader Abdel Fattah el-Sisi, is also up to no good. The Egyptian pound has been a rare riser among emerging market currencies beaten down by coronavirus fallout, but pressure is growing on it to beat a retreat, Reuters reported on April 28.

On April 30, Turkey’s central bank governor Murat Uysal claimed during an online press conference held for the release of the latest inflation report that his institution was not seeking to defend a specific level for the lira.

And that is partially true since the central bank merely acts as the accounting department of the palace administration. It provides dollars to the dutiful state lenders through the backdoor and the “native and national FX teams” at those banks sell them in the lira market.

It is possible that Uysal may have no idea which level exactly Turkey is seeking to defend.

However, Uysal would be better off not trying to fool his audience by saying that Turkey’s exchange rate regime remains free-float when the USD/TRY rate has been smacking its head on the 7.00 ceiling for almost two weeks.

“What is so magical about 7? What about 6.90 or 7.10?” Atilla Yesilada of Globalsource Partners told the Financial Times. Exactement!

The world beyond 7.00…

The “native and national FX teams” at the state banks will try to push the lira back below 7.00 but the USD/TRY rate is inexorably bound for the North. Sudden jumps are not expected, given the dirty float regime and Erdogan’s traders working round the clock.

However, Capital Economics sees a risk of a much larger and sharper adjustment akin to the 2018 currency crisis.

Further rate cuts wouldn’t appear to be a smart move for a central bank intent on defending its currency, but the regulator’s latest inflation report suggests a further fall in inflation expectations for 2020, thus additional monetary easing looks very much on the cards. (In fact, talk of “expectations” is fatuous when you have a regime that has inflation in the pocket thanks to the wired-in team it installed at the national statistical institute in October 2018).

A stable lira, of course, is rather important to Turkish corporates stuffed to the gills with hard currency debt. That being the ugly reality, and with the country’s FX reserves critically low, the pressure on Erdogan & Co to find an overseas source of dollar funding has been cranked up.

Erdogan for political reasons has ruled out making a U-turn on his many times repeated declaration that on his watch Turkey will never return to the International Monetary Fund (IMF) for rescue capital, and a direct appeal to Washington for a swap line from the Federal Reserve has not borne fruit.

With the clock ticking, he still has about $50bn of gross FX reserves in all. The banks have around $20bn in additional FX liquidity, available for swaps, while there is approximately $30-35bn of gross gold reserves at the disposal of the central bank.

The search for swap lines continues, with Erdogan still hoping for some assistance from Donald Trump, so often purportedly eager to take calls from his strongman friend. China donated a 1-year swap worth a billion dollars during the failed campaign mounted by Erdogan to get his candidate elected mayor during the Istanbul “revote” held in June last year. And an existing swap from Qatar was upgraded to $5bn from $3bn in December before maturity.

But—and this is getting a bit plaintive—it is The Donald that Erdogan really needs to see come through. The past week saw Turkey’s top man dispatch medical equipment to the pandemic-shattered US after which it emerged that accompanying the consignment was a letter to Trump from Erdogan begging understanding from the US Congress and American media.

Turks say “If you are in love, you should go and talk to him/her”. Erdogan should perhaps directly confess his rekindled love for Turkey’s spurned Congress allies rather than sending a letter to the wrong address.

Sensible from Satterfield

US ambassador to Turkey David Satterfield said on April 30 that Turkey would need to meet the Fed’s financial and monetary conditions for support, not political conditions. Now that’s very sensible and sobering from Satterfield but he, like all those who serve at the big man’s pleasure, will know that his master is quite capable of all of a sudden turning the ball game upside down with a fit of passion. Pity the bewilderment of the archivists who a few centuries from now, perhaps digging amongst the rubble, will come across Trump’s “Don’t be a tough guy. Don’t be a fool!” letter to Erdogan in which the former told the latter that he wouldn’t want to have to destroy the Turkish economy in response to Ankara going ahead with an invasion of Syria.

Researchers of the distant future should learn that Erdogan was an authoritarian leader dangerous for his shorter-than-yours short-term focus. He last tapped eurobond markets in February with 5-year USD-paper at a cost of 4.45% and 10-year paper at 5.45%.

BloombergHT reported on April 28 that emerging market countries had sold a combined $54.8bn of eurobonds in April with spreads between investment grades and junk jumping to 700bp from 350bp.

As a last resort, Erdogan could pay a 10% coupon for a eurobond issue.

All-in-all, though, his plan is the same, same, same again. Buy time, beg some capital cap-in-hand from anyone possible, fuel baseless hopes such as by frothing up rumours of swaps, distract the electorate by pumping up national prestige or adventurism (the fact that the S-400 missiles, so ostentatiously bought at great expense from the Kremlin, have not yet been taken out the box for fear of crossing the line in upsetting Washington is a weak spot here, but there is still the chance of more military mischief in Syria or Libya) or, as on this occasion by ‘writing’ to Congress via Trump, indirectly signal that you are ready to parley.

During his telecall with the press, Uysal also spilled beans in saying that Turkey was hoping for portfolio inflows in H2.

At the end of the day, with the world in such flux, who can really know where things are heading. Picture waves of foreign tourists bursting out of their self-isolation in June and rushing to Turkey for a holiday, imagine production hubs shifted from China to Turkey due to corona “lessons learned”. Turkey would be ready to emerge as the latest superpower in world politics, once again benefiting from a crisis.

“Crisis”. Now there’s a word that is fast losing any meaning for Turks. “Snafu” is a better appreciation of what they have endured for almost a decade, stumbling from one crisis to another, with the government always suggesting a bright future is right around the next corner.

The coronavirus crisis fairly crashed into Turkey, but it has not changed the Erdogan administration’s policy set and choices. Not yet certain is whether another global surprise is on the way to honour the startling, sorcerous year of 2020.

By: Akin Nazli

Source: bne Intellinews