Following years of mismanagement by an authoritarian president, Turkey’s economy is reeling. Without new leadership or a course correction that includes a tighter monetary policy, Turkish households’ economic prospects will continue to darken, and the impact on the country’s stability will become impossible for others to ignore.

Turkey’s economy is in crisis. Inflation is high and rising, economic growth is stalling, foreign-exchange reserves have plummeted, many goods are in short supply or simply unavailable, and low- and middle-income households are increasingly impoverished. With per capita GDP having fallen from $12,600 in 2013 to $8,500 in 2020, Turkey’s 85 million people have faced dimming economic prospects for the better part of a decade.

Although it receives far less attention than it deserves, Turkey is a geopolitically and economically significant country, sharing territorial or maritime borders with the European Union, Russia, and four Middle Eastern countries. It is the only Muslim-majority member of NATO, and has the Alliance’s second-largest military, after the United States. Its crisis matters far beyond its borders.

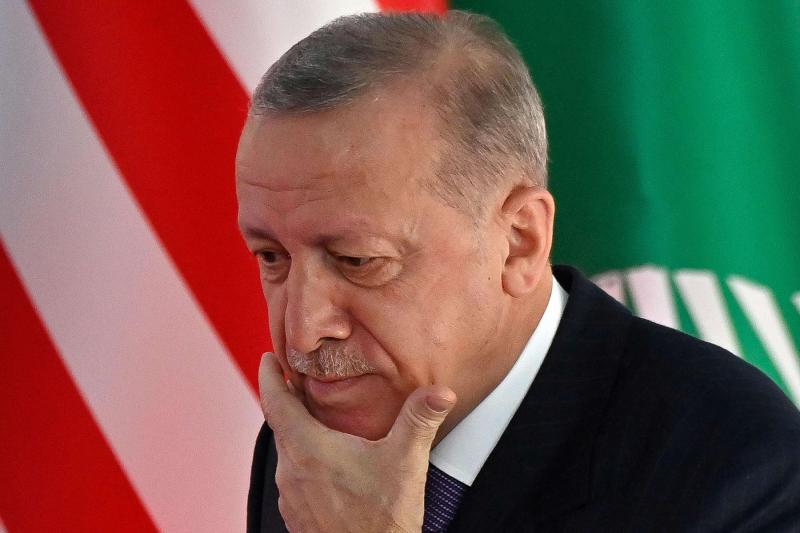

Turkey’s problems are almost entirely self-inflicted. President Recep Tayyip Erdoğan’s government has spent years hollowing out the country’s democratic institutions and sowing division within the population to suppress the rise of a united political opposition. Owing to the strong economic performance of previous years, Erdoğan’s Justice and Development Party (AKP) has been re-elected at every ballot since 2002. But that support has fallen sharply as a result of the deteriorating political and economic situation.

Politically, the Erdoğan government has increasingly come to support the idea of a religious state, even though the constitution mandates a secular one, and it has been ruthlessly suppressing journalists and political dissent since a coup attempt in 2016.

Economic conditions are even worse. When growth began to slow in the mid-2010s, Erdoğan’s government responded by sponsoring large-scale infrastructure investments and encouraging banks to keep interest rates low. But because those outlays were financed from external sources, they created inflationary pressure. The Turkish inflation rate reached double digits in 2017 and has since risen further.

Turkey thus was facing economic difficulties well before the COVID-19 crisis, and when the pandemic arrived, it hit Turkey hard. And though highly aggressive stimulus measures enabled economic growth to resume, the macroeconomic situation has become unsustainable. By the fall of this year, official data put the inflation rate at 21%, but many believed that the true rate was even higher. Market observers anticipate an inflation rate of 30% or more in the coming months. No wonder a sizable proportion of Turks has experienced a severe drop in real (inflation-adjusted) income.

Making matters worse, Erdoğan has long pressured the central bank to keep interest rates low, because he subscribes to a crackpot theory that inflation is caused by high interest rates. Any credible economist would point out that higher, not lower, interest rates are needed to cool inflation. But Erdoğan persists in his perverse belief, and he has replaced the central bank governor three times in the past two years to ensure that the monetary authority continues to do his bidding. Hence, on December 16, the central bank’s new governor lowered interest rates by another percentage point to 14%, putting the real interest rate at -7%.

Moreover, many of the government’s stimulus policies have accelerated inflation without boosting real output, triggering capital flight and a massive depreciation of the Turkish lira, which has lost 45% of its value against the US dollar this year. Having rapidly depleted its reserves, the central bank’s gross reserve liabilities exceeded $150 billion by March 2021, while its assets had fallen to below $90 billion.

As Erdoğan clings tenaciously to his unorthodox policies, goods shortages are becoming more frequent and severe, prompting efforts by some state-owned enterprises to control prices. But the mounting deficits at state-owned firms are increasing fiscal deficits, thereby adding to the inflationary pressures.Sign up for our weekly newsletter, PS on Sunday

Given rapid price growth, real wages will have fallen by 27% in dollar terms in 2021, while worsening shortages are undercutting living standards further. To offset the damage, the government has now mandated a 50% increase in the minimum wage, effective January 1, 2022. But this will simply pour more fuel on the inflationary fire.

If the Turkish government reverses course by tightening monetary policy and committing to other reforms to reduce the fiscal deficit and decrease pressure, such as lifting price controls (especially on state-owned enterprises), it could still stanch the bleeding that it has caused. But as long as Erdoğan calls the shots and persists on his current course, the outlook for Turkey’s economy, and for Turkish households’ well-being, will continue to darken. The impact on the stability of such a strategically important country may become impossible to ignore.

By: Anne O. Krueger – a former World Bank chief economist and former first deputy managing director of the International Monetary Fund, is Senior Research Professor of International Economics at the Johns Hopkins University School of Advanced International Studies and Senior Fellow at the Center for International Development at Stanford University.

Source: Project Syndicate